In The News…

2024

EIN NEWSWIRES: “Peter J. Burns, III Pens His Latest Column for Forbes Magazine, Comparing Chess to Entrepreneurship” - May 2024

CEO WEEKLY: “Peter J. Burns III Dissects How Non-Traditional Financing is Shaping the Future of Startups“ - Apr. 2024

INTERNATIONAL BUSINESS TIMES: “Serial Entrepreneur Peter J. Burns III Reveals Unique Method To Help Aspiring Entrepreneurs Obtain Much-Needed Funding“ - May 2024

FORBES: “What Chess Can Teach Us About Entrepreneurship“ - May 2024

October 2022

EIN Presswire: “Burns Funding Secures $300,000 in a Matter of Weeks for Banker, Who Eyes Passive Income Opportunities” (Oct 2022)

July 2022

EIN Presswire: “Burns Writes for Entrepreneur Magazine About the Role of Diversification to Mitigate Entrepreneurial Risk” (July 2022)

May 2022

April 2022

March 2022

EIN Presswire: “Serial Entrepreneur Peter J. Burns III Featured on the Kim Pagano Show” (March 2022)

Mission Matters: “How this Serial Entrepreneur Launched Over 150 Businesses” (March 2022)

EIN Presswire: “Serial Entrepreneur Peter j. Burns III Publishes Article for Entrepreneur About Passive Income Business” (March 2022)

January 2022

ValueWalk: “Burns Funding Creates a Business Offering that Enables Passive Income Streams” (Jan. 2022)

December 2021- Resources and Knowledge for the Small Business CEO

BURNS FUNDING BINDS TOGETHER A BUSINESS OFFERING THAT PRODUCES PASSIVE INCOME STREAMS!

December ‘21 - Your top news on small business

Burns Funding Binds Together a Business Offering that Produces Passive Income Streams and 'Creates Residual Wealth’

October 2021 - EIN Presswire

Burns Funding Invites Creditworthy Individuals to Participate in Its Brokerage Program!

September 2021 - EIN Presswire

Peter J. Burns III Invited to Speak at 'Family Office Trends for 2021 and Beyond' Conference

August 2021 - EIN Presswire

Millennial Queenmaker ‘Kickstarts’ the Performing Career of Valerie Grace Vadas

August 2021 - EIN Presswire

July 2021 - Forbes Councils

Peter Burns

January 2021 - EIN Presswire

NEWS PROVIDED BY

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies, Education, Military Industry

August 2020 - The National Business Post

The National Business Post: ”Close to Home” (Aug 2020)

July 2020 - The Observer & EIN Presswire

The Observer: “Peter J. Burns III: The Blueprint of an Entrepreneur” (July 21)

EIN Press Wire: “Burns Funding Announces Unique Partnership with Vietnam Manufacturers to Deliver PPE to the United States“ (July 20)

April 2020:

EIN Press Wire: “Cost Segregation Emerges as a Strategy for Property Owners to Lessen Tax Liability, and Enhance Cash Flow” (Apr 21)

EIN Press Wire: “Burns Funding Creates a Platform for Millenials to Start Their Own Business and Rise from the Ashes of COVID019 Crisis” (Apr 10)

EIN Press Wire: “Burns Funding Makes Strategic Investment in LA Based Agora Temple, Plans Expansion Through Rest of State” (Apr 9)

MENAFN: “Burns Funding Makes Donation in LA - Based Agora Temple, Plans Expansion Through Rest of State” (Apr 9)

February 2020:

The Observer: “Entrepreneur Peter J. Burns III Creates the Perfect Solution for an Aging Population” (Feb 29)

January 2020:

Burns Funding, (Jan 2020)

EIN Press Wire: “Leading Law Firm in Opioid Litigation Enlists Burns Marketing for Business Development“ (Jan 7)

December 2019 press:

EIN News Desk: “Burns Funding Offers Innovative 60-Day Credit Building Service, Unlocking Capital for Entrepreneurs and Business Owners“ (Dec. 2019)

EIN News Desk: “Burns Funding Acquires the Exclusive Rights to Market and Sell Nearly 150 medspa810 Franchises in California“ (Dec. 2019)

EIN News Desk: “Peter J.Burns III is Singled Out as Entrepreneurship Expert on National Radio“ (Dec. 2019)

Burns Funding blog: “Exploring the Difference Between a Serial Entrepreneur and Serial Start-up Entrepreneur“ (Dec. 2019)

October 2019

Startup Nation: “Serial Entrepreneur Presents Alternative Methods for Raising Startup Capital through Burns Funding” (Oct. 2019)

Value Walk: “Company helps investors leverage underutilized accounting tool to raise additional capital for investment“ (Oct. 2019)

Value Walk: “Women Entrepreneurs Experience Success by Being Creative when Faced with Obstacles: Study“ (Oct. 2019)

Sweet Startups: “Burns Funding- a Leading Aggregator of Non-traditional Tools for Securing Growth Capital“ (Oct. 2019)

September 2019

EIN PressWire: “Burn$ Funding introduced Another Product – Blanket Loans – to Help Entrepreneurs“ (Sept. 2019)

Real Estate Agent Magazine: “Phoenix is Becoming the Epicenter of the Group Home Movement“ (Sept. 2019)

CPP Luxury: “Serial Entrepreneur Taps into Growing Trend in Eldercare by Launching Luxury Group Homes“ (Sept. 2019)

TECH STARTUPS: “Burns Funding is Becoming the Leading Aggregator of Non-Traditional Tolls for Securing Growth Capital“ (Aug. 2019)

EIN PressWire: “‘DocVestors’ Are the Key Ingredient in Venture’s Rapid Expansion into Group Home Space“ (Aug. 2019)

August 2019

EIN PressWire: “Burn$ Funding Introduces New Division to Help Entrepreneurs Raise Capital by Applying an Underutilized Tax Law“ (Aug. 2019)

Peter J. Burns III Linkedin (blog): “My Very First “Unicorn-in-the Making!““ (Aug. 2019)

KevinMD: “Haven’t thought about investing in group homes? You should.“ (Aug. 2019)

July 2019

MONEY Inc. : “Serial Entrepreneur Taps into Growing Trend in Eldercare by Launching Luxury Group Homes” (July 2019)

NBC29 : “Burn$ Funding Expands Opportunities for Investors with Launch of Behavioral Group Homes” (July 2019)

EIN NewsDesk: “After Four Decades, Peter J. Burns III Hits His Stride as a Highly Successful Serial Entrepreneur” (2019)

EIN Presswire: “Serial Startup Entrepreneur Peter J. Burns III Reshapes Credit Repair Industry by Expanding the Capacity of Bridge Loans“ (2019)

Entrepreneurship Central: “Raising Millions in Donations the Peter Burns Way: An Introduction to Cost Segregation for Charitable Fundraising” (2019)

Best World Travel Services: “HI-TEK Inc. Launches Groundbreaking Vietnam Travel Service Ecosystem, Offering Discounted Tourist Visas, Flights, Hotels, and More“ (2018)

Serial Start-up Entrepreneur Finds Niche in the Credit Repair Industry

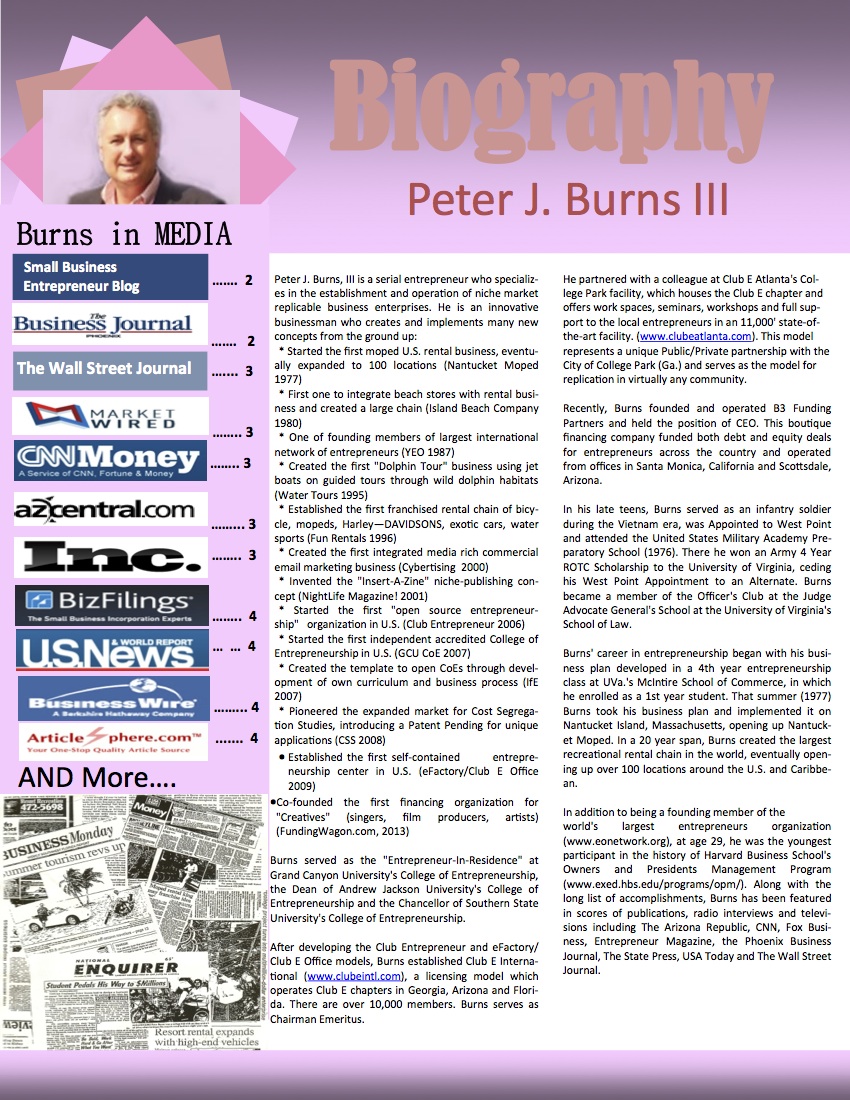

Peter J. Burns III thinks of new business ideas like other people think about their next meal. The ideas are that frequent. The challenge for Burns has always been sifting through the many ideas and building out the good ones. There are only so many hours in the day, even for Burns, who rarely sleeps. Burns, who by his own count has started, run, sold and/or expanded between 100-150 individual businesses in dozens of fields, believes he recently found a good one by connecting the dots in a very fragmented industry. The company, Burns Funding, is near and dear to Burns’ heart. “As any serial entrepreneur will tell you, not every business is a home run,” said Burns. “Some fail through no fault of the entrepreneur, leaving the small business owners in debt, and their credit score plummeting.

“The same is true of regular people, who suffer a run of bad luck, or perhaps were overly optimistic about their financial future. Again, I’ve been there.” What Burns has done is as follows: Let’s say John Doe has $50,000 in high interest credit card debt and credit score around 600. Doe is struggling to make ends meet because of the monthly payments. Doe goes to a credit repair service and asks for their help. Some credit repair services will clean up some of the incorrect reporting and resolve other issues. Others will do that, and they have an individual at their disposal, who is willing to loan money to the applicant, a bridge loan, so he can pay down debt. This would reduce Doe’s all-important Credit Utilization Ratio (CUR), which is a key measuring stick for a credit score, down to 45 percent. This will provide a sufficient bump in the credit score for Doe to obtain low interest debt and pay off the credit card debt, thus reducing the monthly payment associated with credit card interest.

Where Burns has come in is by connecting with multiple financial institutions that are willing to make a bridge loan at a lower interest rate than the individuals. In addition, he has hammered out an agreement with the institutions, where they will go far below the 45 percent CUR to 30 percent or lower. This means Doe is able to pay off more of the high-interest debt, further increasing his credit score and qualifying him for a greater amount of low-interest money. Thus, Doe ends up paying less each month in interest.

Why hasn’t anyone else in the industry done this?

“The main reason is the industry is highly fragmented,” said Darrell Hornbacher, President of Midas-Financial, which is the largest credit repair company in Arizona and has 35,000 credit score restorations to its credit. “This industry has been growing so fast that we all have our hands full servicing new customers. No one is incentivized to move up or down the food chain and create a dynamic marketplace. What Peter Burns is doing, in many ways, is the missing link, creating winners out of everyone in the process. Peter certainly wins, the financial institutions win, and we win. Most importantly, the customer wins because they are paying substantially less in interest each month.”

Burns, for his part, does not fancy himself as a White Knight. Rather he is a capitalist, whose experience as a serial entrepreneur has helped him spot opportunities. “Since founding my first company as a teenager, I have found that my expertise lies primarily in the establishing and growing of niche market businesses in fragmented industries … of any kind,” said Burns. “Fortunately, I have a particularly good skill set of recognizing opportunities early on in the process and being able to fund almost any enterprise with creative financing techniques I’ve learned over my career. “This is the first company to offer a vertical integration approach of repairing credit and providing fresh new debt capital at rates and terms that benefit everyone involved,” he said.

Hornbacher is a believer.

“Peter has disrupted our industry in a matter of weeks, just as the companies that offered credit card stacking did several years ago,” he said. Burns is philosophical about his company’s ability to dominate market place. “Look, 100 companies like me could come into the space tomorrow and do the same thing,” he said. “But there’s enough capital floating around that each of those companies can be successful. There’s that much inefficiency in the marketplace.”

2013:

BusinessWire: Club E Atlanta – a Shining Example for Other Cities That Want to Create Small Business Growth (July 2013)

Inter Press Service News: “Using Ethiopia’s Healthcare Gaps to Do Good and Make a Profit” (2014)

Digital Journal: "Entrepreneur has Solution for Businesses Squeezed by Government” (2013)

Phoenix Business Journal: “Grand Canyon University Creating College for Entrepreneurs” (2006)

MORE FEATURED ARTICLES

Club Entrepreneur

Connecting the Dots in Luxury Business Deals (11/03/2016)

Club Entrepreneur Global Network Launches Local Chapter in College Park (06/23/2011)

Club E Monthly Meeting w/ Founder Peter J. Burns, III (03/11/2010)

Entrepreneurs Help Each Other (12/18/2008)

Club mentors East Valley entrepreneurs (09/22/2008)

8,000-square-foot center to house 40 small firms (08/25/2008)

Knowledge resources for entrepreneurs: Club E Network (11/11/2007)

New club to bring together like-minded entrepreneurs (02/11/2007)

Focus on values helps entrepreneurs soar (11/12/2006)

Peter J. Burns, III Serial Entrepreneur

Funding Wagon Helps Create a Star in LV Sharp; Firm Hopes to Back Other Entertainers (05/22/2013)

Entrepreneur has solution for businesses squeezed by government (04/02/2013)

Can Entrepreneurs Rescue the U.S. Economy? (12/14/2011)

Young and in Charge (12/02/2008)

Can Entrepreneurs Rescue the U.S. Economy? (10/02/2008)

Down economy still offer options for entrepreneurs (08/27/2008)

Don’t Expect Entrepreneur Programs to Spur Local Growth (08/15/2008)

Peter Burns opens new entrepreneurial program in San Diego (07/11/2008)

Arizona Veterans Small Business Conference aims to help veteran-owned businesses (06/01/2008)

Entrepreneurship Icons Michael Gerber and Peter J. Burns, III Plan National Rollout of Club Entrepreneur (07/27/2007)

A wealthy University dropout (07/03/1985)

Bicycles and Nantucket (Spring 1992)

Spearheading Education in Entrepreneurship

Peter Burns opens new Entrepreneurial program in San Diego (07/11/2008)

Going Glam—Learn what it really takes to start a glamorous business in college. (11/30/2007)

Entrepreneurs come in all age groups (02/25/2007)

Valley’s entrepreneurial scene can offer a bright future, with support (01/25/2007)

Institute for Entrepreneurship Celebrates First College of Entrepreneurship at Grand Canyon University (02/09/2007)

Grand plans: University proposing multimillion-dollar Lake Havasu expansion (02/01/2007)

Entrepreneurship college opens in Phoenix (01/29/2007)

Undergraduate Entrepreneurship College Opens in Phoenix (01/26/2007)

College of Entrepreneurship to Offer Scholarships to Low-Income Students Seeking to Start Their Own Business (01/16/2007)

Grand Canyon launches executive MBA program (08/30/2006)

Gen Y makes a mark and their imprint is entrepreneurship (12/08/2006)

A B.S. in entrepreneurship is anything but (11/15/2006)

Both entrepreneurial, managerial styles bring success (09/17/2006)

University launches $1M entrepreneur fund (07/23/2006)

Programs teach entrepreneurism (07/09/2006)

Peter J. Burns, III Co-Working Space Creator

Response to Request for Proposal- Tempe Business Incubator, Tempe TX (03/19/2012)

Six eFactory sites to be housed in retail spaces (09/16/2008)

Club E Network launching companies (08/25/2008)

New chef to spice up Sheraton Downtown (07/27/2008)

My View: Entrepreneurship Conference offered many gems (11/18/2007)

Institute for Entrepreneurship To Join DECA’s National Advisory Board (04/20/2007)

StartupNation Announces New Blog on Starting a Successful eBay® Business (03/21/2007)

Entrepreneurs seek school funds (03/04/2007)

Club Entrepreneur geared to be inclusive, supportive (11/26/2006)

Arizona Entrepreneurship Conference (10/17/2006)

Peter J. Burns, III Awards and Recognition articles

Arizona Chapter of the FBLA Names Peter J. Burns III as Its Businessman of the Year (6/19/2007)

Video Coverage

Peter J. Burns III on Rockstar Radio (04/10/2010)

IN THE NEWS

National and local news about the Institute of Entrepreneurship and the College of Entrepreneurship.

Venturecast - Peter Burns Interview

Peter Burns, the Founder of the Institute for Entrepreneurship, joins us today to share his story. Peter has launched numerous initiatives in Arizona having the first ever college-accredited program on entrepreneurship.

Listen to Interview >

New club to bring together like-minded entrepreneurs

Club Entrepreneur is bringing seasoned entrepreneurs and future startup business leaders together.

Read Article >

The only 'pureblood' Bachelor of Science in entrepreneurial education

$4.5M in startup money for students with great ideas.

Read Article >

Encouragement offered to launch own business

University launches $1M entrepreneur fund

The University Entrepreneurs Fund was conceived to assist student entrepreneurs in initially capitalizing the business projects they create.

Read Article >

College of Entrepreneurship

Entrepreneurship is the fastest-growing course of study on campuses nationwide, but never before have would-be moguls been able to get a degree in the field. Until now.

Read Article >

E-Myth Founder Michael Gerber to Be Chairman

The College of Entrepreneurship will house several unique enterprises, including an Entrepreneur Factory, a Club Entrepreneur and an e-Lab.

Read Article >

Both entrepreneurial, managerial styles bring success

You may be moving out of your entrepreneurial comfort zone into the professional management arena, said Peter Burns.

Read Article >

The New Entrepreneur Factory

More students are taking business risks right out of college. Peter Burns is well aware of this trend and has gained public attention for his latest venture: a college devoted solely to the study of entrepreneurship.

Read Article >

Hello, World!